You work hard to save up for retirement! To make sure you are able to keep as much as possible of that hard earned money when you retire, it is critical to have a proper tax plan in place. Remember that every dollar saved into a tax-deferred plan, such as 401(k) and traditional IRA plans, will be taxed upon withdrawal of funds after retirement. A well thought out tax plan can help you reduce taxes by minimizing your tax burden in retirement.

If you have not thought about tax planning yet, it is not too late. It is also never too early to start your tax planning for retirement. Below we have outlined nine steps for you to consider as you approach and enter into retirement:

1. Know How Much You Spend

If you do not know how much money you spend today, or will spend in the future, it is very difficult to know what you can realistically afford to spend your hard earned money on. Many people believe that their expenses will go down in retirement; however, that really depends on your desired lifestyle. If you plan to travel more, take up new hobbies or to help your children and grandchildren, you need to consider that all of these activities will cost money. Furthermore, it is critical to consider your healthcare costs and properly plan for them: make sure you understand Medicare and supplemental health policies and your out of pocket costs associated with each. When you know how much you spend, or plan to spend, you can begin to set up a tax efficient strategy for your withdrawals.

2. Know Your Tax Bracket and its Implications

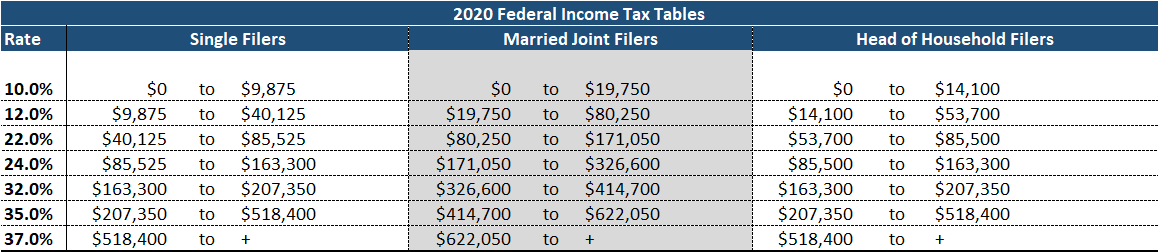

It is beneficial to know what tax bracket you are in and how close you are to the next tax bracket, up or down. Staying in a lower tax bracket can help retirees minimize taxes owed, and paid, on withdrawals from their retirement accounts. As your income increases and reaches a specified threshold, you will gradually pay higher taxes on the incremental income. Feel free to check out the 2020 tax brackets and rates in the table below. You may want to consider reducing the amount of withdrawal if your current withdrawal plan would just barely put you into a higher tax bracket.

3. Diversify Your Accounts to provide flexibility and opportunity to reduce taxes

Just like making sure your investments are diversified, having a diverse set of accounts that are taxed differently can provide flexibility when making withdrawals in retirement and can have a significant impact on your taxes. You may have a pension, IRAs, 401(k)s, as well as stocks and bonds in non tax-deferred accounts. This will give you the option to withdraw funds from different buckets depending upon your tax situation. In certain situations it may make sense to withdraw from accounts that have already been taxed (such as Roth IRA’s or Roth 401(k)’s), rather than withdrawing from all accounts equally, and letting tax deferred accounts grow to reduce taxable income. Of course, Required Minimum Distributions (RMD’s) must be considered as they must be taken from age 72.

If you do not have a Roth IRA or a Roth 401(k) you may want to reach out to an accountant, a financial planner or your HR department to find out if you can open one and whether a Roth is right for you (see number 4 below on this as well).

4. “Backdoor Roth IRA’s” can be Tricky – Exercise Caution!

If you are a high income earner you may not be able to open a new Roth IRA account. However, you may want to consider establishing a Roth IRA by putting $5,500 into a traditional nondeductible IRA and then converting it to a Roth IRA in the future. This strategy is called a “Backdoor Roth”, but it can be tricky, so please exercise caution! You may have other IRA accounts that were funded with deductible contributions. In that case, the amount converted to the Roth IRA is deemed to have come pro-rata from all you IRA accounts and not just from the nondeductible IRA you set up with the purpose of converting into a Roth IRA. The result is that some of your conversion may be taxable. Again, you may want to reach out to an accountant or a financial planner if you are considering this option.

5. Consider Roth IRA Conversions

Another important tax strategy to consider is to make Roth IRA Conversions, which can significantly save on taxes over time and increase your net worth. We are in a historically low tax environment right now, and we believe taxes will go back up again in the future. So, systematic partial Roth conversions could be a very good move for you over the next few years. Here is how you do it:

- Take enough money from your Traditional IRA to fill the lowest tax bracket each year, for the next 5 years, and use that amount to convert to a Roth.

- For instance, the lowest tax bracket for married filing jointly is 10% and is capped at $19,750.

- So you take that $19,750 from your IRA each of the next 5 years and convert it to a Roth.

What this strategy does is two things for you:

- First, since you’re taking money from your IRA to do the conversion, you pay taxes at the time of the conversion, which temporarily makes you pay higher taxes.

- But the trade-off is that it lowers your IRA base.

- So, when you have to start taking RMDs (Required Minimum Distributions) at age 72, from your Traditional IRA, the RMDs are based on a lower amount.

- Thus, you save on taxes in the long run.

- But the trade-off is that it lowers your IRA base.

- Secondly, what happens is that your Roth bucket starts growing.

- And since it is the last bucket of money you should touch, in an ideal situation, its growth causes your net worth to increase.

- If you are older than 59 ½ and have had a Roth IRA for more than five years you can withdraw money from the Roth account tax-free.

- And since it is the last bucket of money you should touch, in an ideal situation, its growth causes your net worth to increase.

6. Delay Withdrawals, if possible

In a climate where the financial markets are rising it may be wise to delay your tax-deferred account withdrawals, if possible. By doing so you allow those accounts to continue to build tax-deferred and pay taxes on the gains at a later point in time when you may be in a lower tax bracket. If you do not need to use funds from your IRA’s or 401(k)’s right away, it may serve you well to leave them alone for as long as you can or until you must take those Required Minimum Distributions at age 72.

7. Understand the rules for Social Security can help reduce taxes

In general it does not pay off to start claiming Social Security retirement benefits before full retirement age. Full Retirement Age (FRA) is 66 for people born between 1943 and the end of 1954. That age goes up by two month increments until age 67 for those born in 1960 or later. Even though the general rule is that it is to your benefit to wait to claim Social Security, the reality is that everybody’s situation is different, and sometimes, it does make sense to take Social Security earlier given your cash flow situation.

There used to be many strategies to game or maximize Social Security. All that has changed, and nowadays, once a person files for Social Security, the maximum benefits will be paid based on what he or she is eligible for. That consideration basically boils down to the following 2 options for you:

- You can either claim based on your own earnings.

- Or, if your spouse has already claimed, you can claim a spousal benefit.

- If 50% of your spouse’s full benefit is greater than your own benefit.

Now, you will hear many financial advertisements that try to get your attention by saying things such as, “The 567 ways to claim Social Security. Which way is right for you?” However, the truth is much of the guesswork and many of the strategies are gone. With all the confusion regarding Social Security, here are some general rules of thumb to help you maximize Social Security:

- If you are comparing retirement at age 62 (which is the earliest you can take Social Security) with FRA at age 66, your break-even is typically age 77 or 78.

- What that means is, if you wait until age 66 to claim, then you must live to age 78 for that decision to have paid off, economically.

- What that means is, if you wait until age 66 to claim, then you must live to age 78 for that decision to have paid off, economically.

- If you are comparing full retirement at age 66 with delayed retirement at age 70, your break-even is typically about age 82.

- What that means is, if you wait until age 70 to claim, then you must live to age 82 for that decision to have paid off, economically.

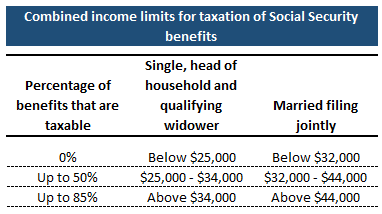

Whatever your income, the income tax limit for your Social Security benefit is capped at 85%. See the table below for guidelines for the taxation of Social Security benefits:

If you are married, widowed, or divorced having been married for more than 10 years, your claiming strategy gets a bit more complex, and making the right choice for you may be even more important. You may want to speak to a financial planner about strategies you should consider. Remember that your Social Security income taxable, depending how much income you receive from other sources, including withdrawals from retirement accounts.

8. Decide Where to Live in Retirement

Many factors go into deciding where to live in retirement: warm climate, affordable housing, proximity to family and friends. In addition, taxes can play a role in where you decide to spend your retirement: how are your income and assets taxed where you want to live? States have different tax rules that are beneficial to know before making final decisions so that you are prepared for the taxes you will pay. In some states you do not have to pay income tax, in others you may not be taxed on your Social Security benefits and/or your pension and retirement accounts. It is well worth the time to investigate the states you are considering to make sure you are comfortable with the tax implications of where you decide to live in retirement.

9. How can you reduce taxes in, and before, retirement? It Starts with a Plan!

We recommend that you have a plan in place before you retire, but if you are approaching retirement or are already retired, please note that it is not too late to take advantage of the benefits of tax planning or financial planning. A financial planner will be able to help guide you to set your goals and, from there, develop a plan specifically for you and your situation to help you maximize your income and reduce your taxes in retirement. A financial planner will also work closely with your accountant to make sure your plan is properly executed. If you do not have an accountant we will be happy to introduce you to some of the accountants that we work with.

As always, please remember that tax laws are constantly changing and that unexpected circumstances can arise. It is important to keep in regular contact with your advisors to make sure you are on the right track so that you can spend time enjoying life!